China’s “Robot Dividend” Begins to Take Shape in Manufacturing

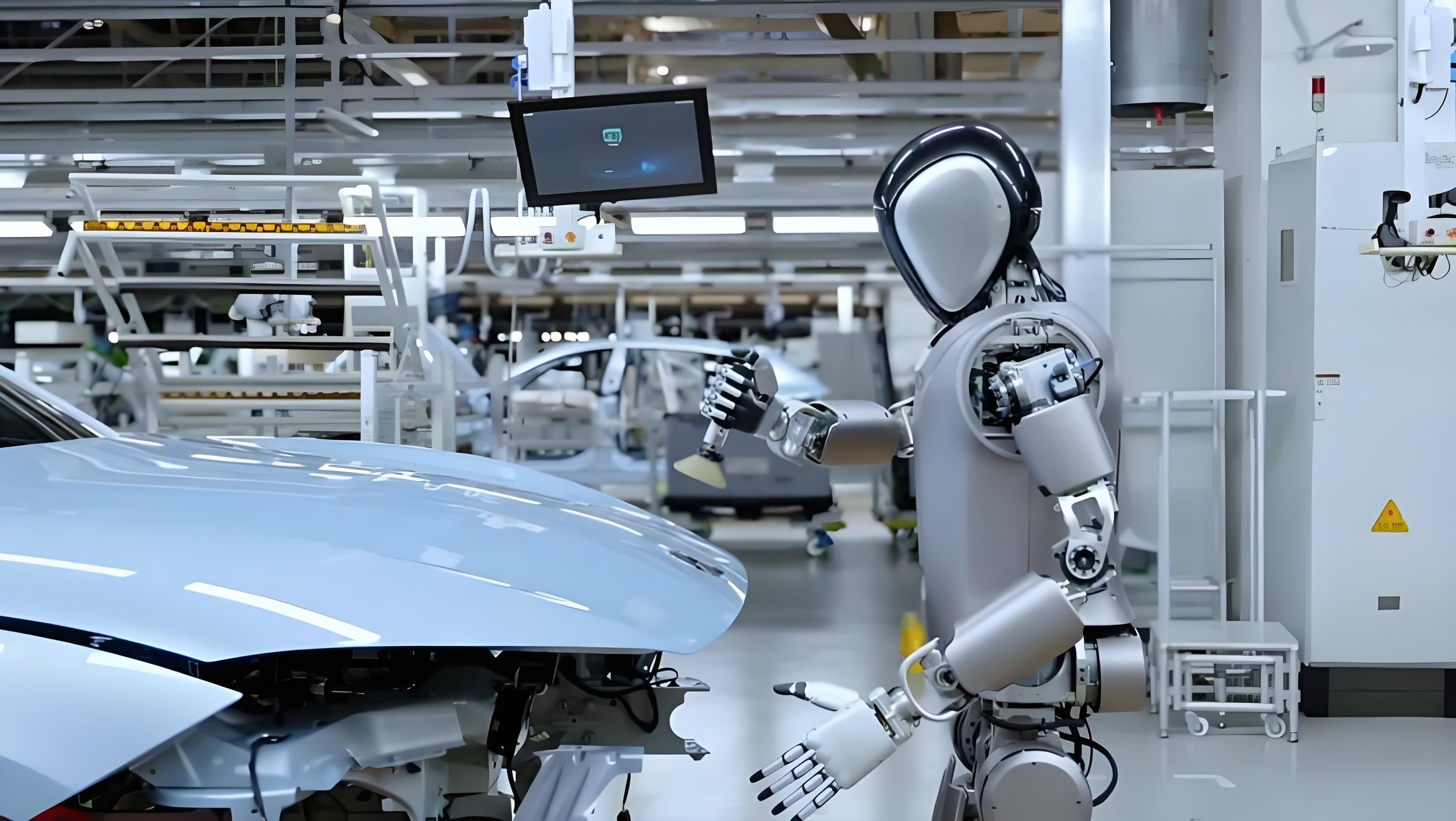

China’s high-tech manufacturing sector is accelerating its shift toward automation. From January to September, factories in China produced 595,000 industrial robots—more than the total output of all last year, according to CCTV. This surge marks not just higher production, but a broader transformation in how Chinese industry operates.

As costs fall and applications expand, robot adoption is spreading beyond specialized sectors into mainstream manufacturing. China now has 470 industrial robots per 10,000 workers, well above the global average. Industries such as photovoltaics, power batteries, and electric vehicles are already benefiting from greater precision, efficiency, and consistency enabled by automation.

China is making itself into a robotics giant

China is both the world’s largest producer and largest market for industrial robots. The rapid rollout is creating what some analysts call a “robot dividend”—a new phase of productivity growth built atop the country’s existing manufacturing base. At the same time, a rising, more technically skilled workforce is contributing to an emerging “engineer dividend,” reinforcing innovation and operational resilience.

Other global economies looking to rebuild manufacturing capacity face similar pressures—aging labor pools, rising costs, and the need for higher-quality output. China’s gradual automation strategy offers a reference point for how robotics and AI can support productivity while coexisting with human labor.

The shift is still early, but the trajectory is clear: industrial robots are becoming a core pillar of China’s manufacturing competitiveness, shaping how factories work, how value is created, and how the next era of industrial growth will unfold.