North American Robot Orders Rebound in 2025 as Automation Investment Expands Across Industries

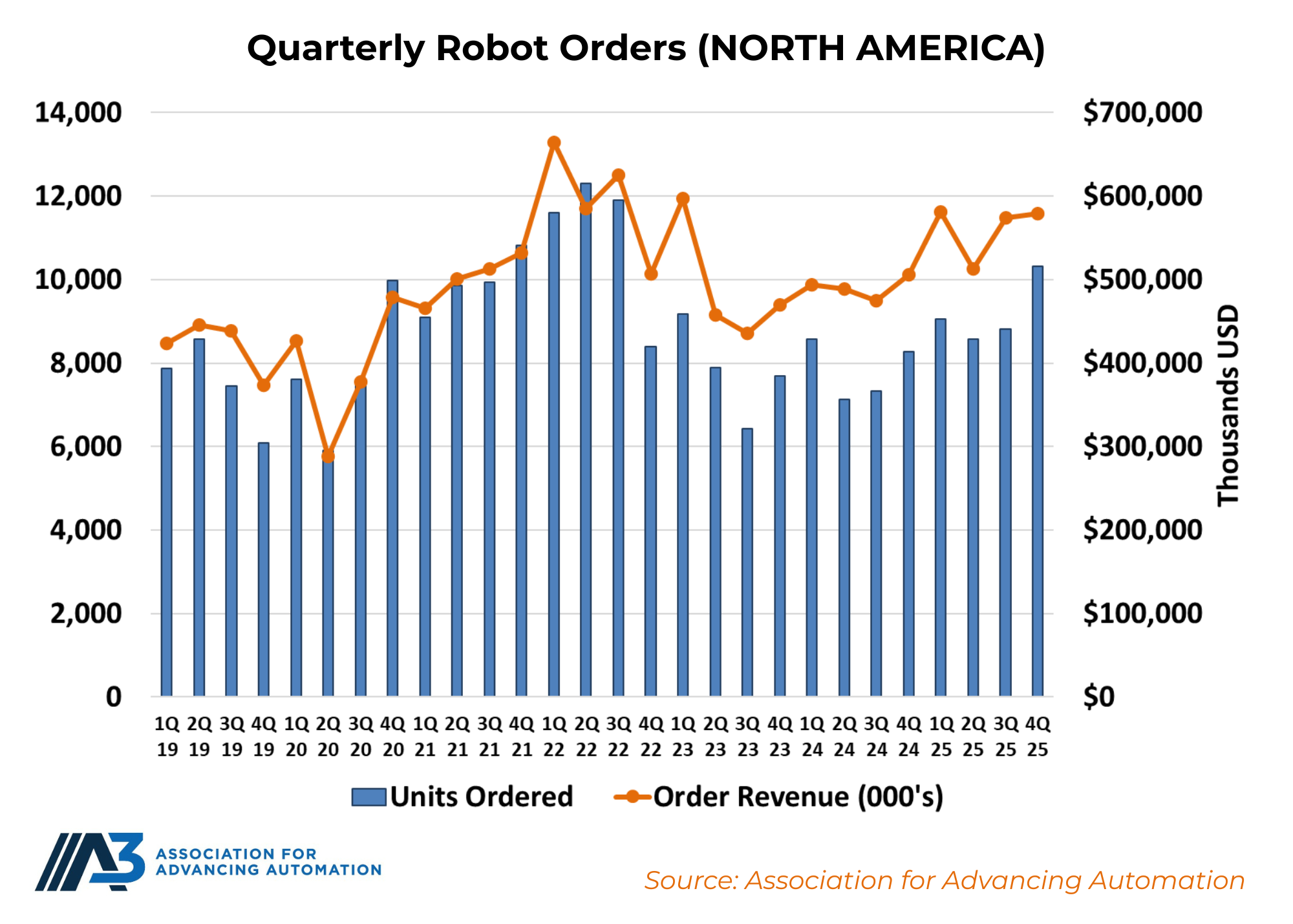

After a slowdown in 2024, robot orders across North America rebounded in 2025, signaling renewed confidence in automation and growing investment across a wider range of industries. New data from the Association for Advancing Automation (A3) shows that both order volume and revenue increased as manufacturers accelerated automation strategies to address workforce shortages, productivity demands, and supply chain shifts.

According to A3, companies across North America ordered 36,766 robots in 2025, representing a total value of $2.25 billion. Compared with the previous year, this marks a 6.6% increase in units ordered and a 10.1% rise in revenue.

“The rebound in robot orders over the course of 2025 reflects renewed confidence in automation as a long-term solution to competitive pressures,” said Alex Shikany, executive vice president at A3. “We’re seeing increasing adoption across sectors, especially in general industry applications and at automotive OEMs, as manufacturers look to automation to address workforce shortages, manage reshoring initiatives, and boost productivity.”

General industry leads growth beyond automotive

One of the most significant trends in the 2025 data is the continued diversification of robotics adoption beyond traditional automotive applications.

Demand from non-automotive sectors outpaced automotive industry orders throughout the year, with general industry accounting for the majority of units purchased. Key growth areas included food and consumer goods manufacturing, semiconductor and electronics production, and life sciences.

While orders from automotive component suppliers remained below 2024 levels, automotive original equipment manufacturers (OEMs) showed renewed activity, particularly in the latter half of the year. A3 noted that increased investment from major vehicle manufacturers could signal stabilization in core automotive markets heading into 2026.

Strong fourth quarter caps year of steady growth

Momentum in the fourth quarter helped drive overall annual performance. In Q4 2025 alone, companies ordered 10,325 robots valued at $579 million — a 6.6% increase in units and an 8.7% increase in revenue compared with the same quarter in 2024.

This marks the sixth consecutive quarter of year-over-year growth, bringing annual totals to their highest levels since 2022.

The sustained quarterly gains suggest that manufacturers are continuing to prioritize automation investments despite broader economic uncertainties.

Collaborative robots gain traction

Collaborative robots, or cobots, continued their upward trajectory in 2025, highlighting a shift toward more flexible automation systems designed to work alongside human operators.

Force- and power-limited collaborative robots accounted for 28.6% of all robots ordered in Q4 2025, totaling 2,953 units valued at $85 million. This represents the highest quarterly volume recorded since A3 began tracking cobots as a distinct category in early 2025.

Across the full year, companies ordered 7,212 collaborative robots worth $241 million. Cobots represented 19.6% of total robot units ordered and 10.7% of overall revenue, underscoring their growing role in modern manufacturing and logistics environments.

Outlook for 2026

A3 expects the upward trajectory to continue into 2026, supported by a combination of automotive recovery and sustained growth in general industry sectors.

“Automotive OEMs came back strong in the second half of the year, which often serves as a leading indicator for growth in supplier and component markets,” said Shikany. “Combined with steady demand across food, electronics, and other non-automotive industries, this points to a positive outlook for 2026.”

As automation expands beyond its historical strongholds, the data suggests that robotics adoption is increasingly driven by broader operational challenges — including labor constraints, reshoring strategies, and the need for resilient production systems — rather than cyclical industry trends alone.