North American Robot Orders Rise in Q3 2025, Showing Renewed Strength in Automation Markets

North American robot orders surged in the third quarter of 2025, signaling a renewed wave of investment in automation as manufacturers prepare for rising demand and continued workforce pressures. According to newly released data from the Association for Advancing Automation (A3), companies ordered 8,806 robots valued at $574 million in Q3.

The figures represent an 11.6% increase in units and an impressive 17.2% rise in revenue compared to the same quarter last year, underscoring a broad recovery in capital spending despite economic uncertainties. Industry analysts characterize Q3 as a turning point: after a turbulent start to 2025 marked by inflation, interest rate sensitivity, and uneven industrial output, manufacturers across North America appear to be returning to long-term automation strategies, particularly as they confront rising labor costs, reshoring initiatives, and persistent labor shortages.

With strong contributions from multiple non-automotive sectors, Q3’s results highlight the shifting center of gravity in the robotics market and the increasing role of automation as a foundation for competitiveness.

Automotive OEMs and Consumer Goods Lead the Rebound

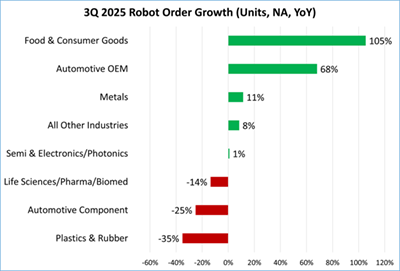

Much of Q3’s momentum was driven by striking sector-level gains that reveal how different industries are adapting to the current manufacturing landscape. Food and consumer goods manufacturers posted a 105% year-over-year increase, the strongest performance among all tracked sectors. Analysts attribute this surge to several converging forces: growing consumer demand for packaged and ready-to-eat foods, labor shortages in food processing facilities, and rising adoption of hygienic and flexible automation systems designed for compliant environments.

Meanwhile, automotive OEMs saw orders climb 68%, reflecting continued investment in platform modernization, EV-related production lines, and long-term workforce supplementation strategies. Additional growth came from metals (+11%) and a wide “all other industries” grouping (+8%), which together point toward broad-based interest in automation across general manufacturing.

Not all segments fared equally well: automotive component orders fell 25%, likely tied to inventory corrections and supply chain recalibration, while plastics and rubber dropped 35%, reflecting caution in sectors sensitive to raw material volatility. Still, the overall trajectory suggests that manufacturers are returning to automation not just as a cost-saving measure but as a buffer against volatility and a prerequisite for scaling.

Collaborative Robots Expand Market Presence

Collaborative robots—long viewed as a gateway to automation for small and mid-sized manufacturers—continued expanding their market share in Q3. A3 reported that 1,174 collaborative robots valued at $42 million were ordered during the quarter, representing 13.3% of all robot units sold in North America.

This steady rise highlights cobots’ growing appeal as user-friendly, flexible tools that address immediate labor challenges without requiring major facility redesigns. Their presence has also grown in industries such as food processing, electronics assembly, and consumer goods packaging, where agility and rapid changeovers matter as much as throughput.

Across the first nine months of 2025, cobot orders reached 4,259 units valued at $156 million, solidifying their role as one of the fastest-growth segments in the automation landscape. Manufacturers continue to adopt cobots for machine tending, palletizing, inspection, and material handling—tasks once too variable or labor-intensive for traditional industrial robots. A3 says future reports will offer deeper visibility into how specific industries are using cobots, a sign of the category’s maturing identity and increasing influence on overall automation strategies.

Third Quarter Performance Lifts Year-to-Date Totals

The positive momentum from Q3 significantly boosted year-to-date totals for the North American robotics market. From January through September, companies ordered 26,441 robots valued at $1.7 billion, a 6.6% increase in units and a 10.6% rise in revenue compared to the same period in 2024.

These numbers reflect not only a rebound from last year’s cautious environment but also a broader structural shift: automation is no longer concentrated in a handful of major industries but is becoming central to operational resilience across sectors.

Manufacturers are increasingly turning to automation to stabilize throughput, reduce dependence on unpredictable labor markets, and support reshoring efforts aimed at strengthening North American supply chains. While certain sectors continue to face capital constraints, the overall pace of adoption suggests rising confidence heading into 2026. Industry leaders note that if industrial production continues to improve and supply chains stabilize, robotics demand could accelerate further, setting up 2026 as a strong year for automation investment across the region.