LG’s Bet on Home Robots Signals a Strategic Shift Toward Physical AI

For most of its modern history, LG Electronics has been a company defined by objects. Televisions, refrigerators, washing machines—products that filled homes, anchored living rooms, and quietly shaped everyday life. But in 2026, LG is beginning to tell a different story. Not about objects, but about intelligence. Not about devices, but about labor.

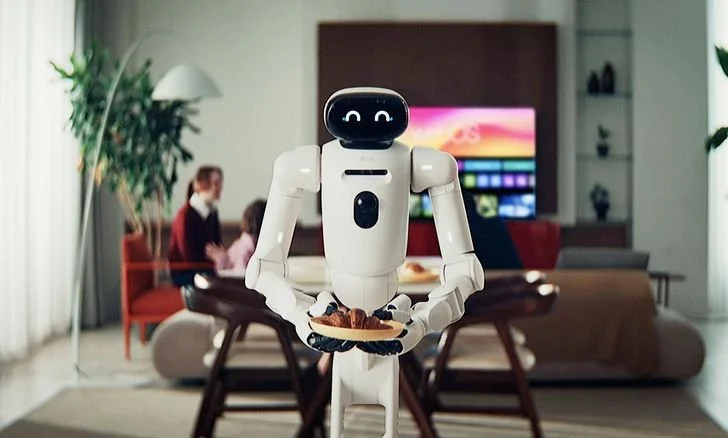

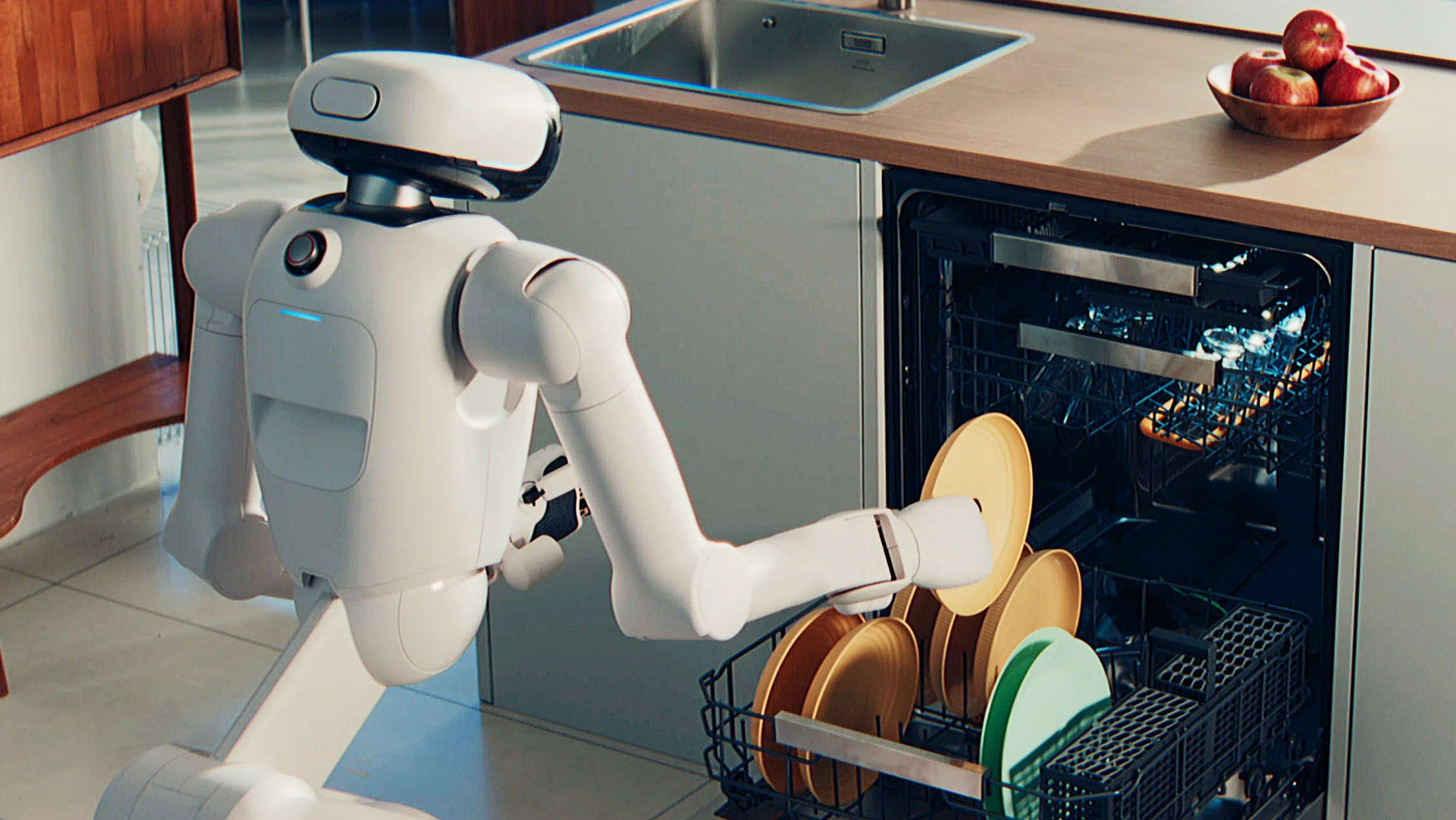

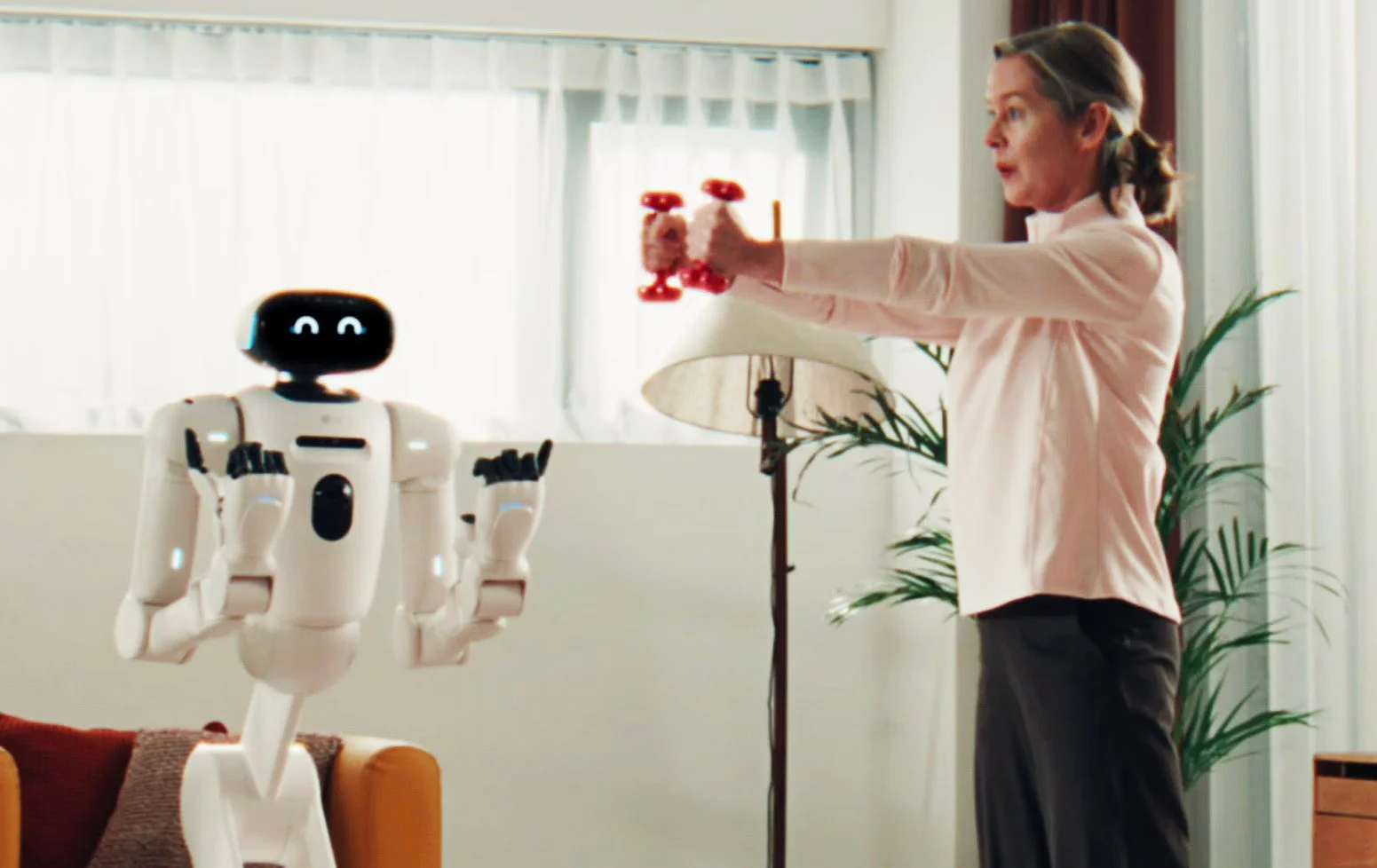

When LG unveiled its CLOiD home robot at CES 2026, the demonstration felt less like a product launch and more like a philosophical statement. The robot folded towels, retrieved milk from a refrigerator, and interacted with its environment with an almost theatrical calm. These were modest tasks, yet they carried symbolic weight. LG was not merely showing what a robot could do; it was articulating a vision of what the home itself might become—a “zero labor home,” where machines increasingly absorb the invisible work that has long defined domestic life.

Behind this vision lies a more pragmatic reality. LG’s traditional businesses, once engines of reliable growth, are showing signs of strain. In 2025, the company generated roughly 89.2 trillion won in revenue, equivalent to about $62.3 billion, a record in absolute terms but only a modest increase over the previous year. Operating profit, meanwhile, fell sharply to approximately $1.73 billion, reflecting rising costs, sluggish demand in display products, and the financial impact of restructuring. By the fourth quarter, the strain had become more visible, with LG recording an operating loss of around $76 million despite revenues exceeding $16 billion.

These figures tell a story that extends far beyond LG. The global consumer electronics industry is entering a mature phase in which incremental innovation no longer guarantees meaningful growth. Televisions face relentless competition from Chinese manufacturers, compressing margins and accelerating commoditization. Home appliances remain profitable but increasingly constrained by saturation and price sensitivity. In such an environment, even companies with strong brands and engineering capabilities find themselves searching for new narratives—and new revenue models.

It is in this context that LG’s turn toward robotics begins to make sense. The company argues that it is uniquely positioned to build intelligent machines for the home because it already understands the home better than most technology firms. Decades of experience with motors, actuators, sensors, and embedded systems have given LG a deep reservoir of technical knowledge. Its industrial and service robotics efforts have further expanded this expertise, while its appliance business has provided insight into how people actually live, move, and behave in domestic spaces.

Yet the shift is not simply technical; it is strategic. LG is increasingly investing in AI-driven factories, data center cooling technologies, and robotic platforms, signaling a broader transformation from a hardware manufacturer into an infrastructure provider for physical AI. At the same time, its business-to-business divisions—automotive components and HVAC systems—are gaining momentum, while subscription-based appliance services are growing rapidly. Together, these trends point toward a future in which LG’s value lies less in selling individual products and more in orchestrating systems, services, and data flows.

The idea of the zero labor home, then, is not merely a marketing slogan. It is an attempt to redefine what consumer technology means in an age when software, AI, and automation are converging. For decades, digital platforms reshaped communication, commerce, and entertainment. Robotics promises to extend that transformation into the physical world, automating not just information but effort itself.

But the path to that future is far from guaranteed. Homes are among the most complex environments imaginable: unpredictable, safety-critical, and deeply human. Unlike factories, they resist standardization. Unlike smartphones, they cannot be upgraded with a simple software patch. The economics of home robots remain uncertain, and the social implications—who benefits, who pays, and who is displaced—are only beginning to be understood.

In this sense, CLOiD is less a finished product than a question posed in mechanical form. Can robots move beyond spectacle and become genuinely useful companions in everyday life? Can consumer electronics companies reinvent themselves as architects of artificial labor? And can the promise of embodied AI overcome the stubborn realities of cost, safety, and complexity?

LG’s experiment suggests that the future of robotics will not be decided solely in research labs or startup incubators. It will be shaped by legacy companies wrestling with the limits of their own success, searching for new ways to remain relevant in a world where hardware alone is no longer enough.

If televisions once defined the modern living room, robots may define the next one. Whether that future arrives as a quiet convenience or a profound social shift remains uncertain. But one thing is clear: LG’s bet on home robots is not just about technology. It is about the reinvention of work, space, and the meaning of intelligence inside the home.